The Necessary Guide to Home Loans: Unlocking the Benefits of Flexible Financing Options for Your Desire Home

Navigating the intricacies of home loans can usually really feel difficult, yet recognizing adaptable financing choices is important for prospective property owners. With a selection of lending kinds available, consisting of government-backed choices and adjustable-rate home loans, debtors can tailor their funding to straighten with their specific monetary scenarios. These flexible alternatives not just provide lower initial payments yet might likewise offer unique benefits that boost availability to homeownership. As you consider the myriad of selections, one must ask: what elements should be prioritized to make sure the most effective fit for your financial future?

Recognizing Home Loans

Understanding mortgage is necessary for potential home owners, as they represent a significant financial commitment that can impact one's financial wellness for many years to come. A home car loan, or home mortgage, is a sort of debt that permits individuals to borrow cash to buy a residential or commercial property, with the residential property itself functioning as security. The lending institution gives the funds, and the customer accepts pay off the lending quantity, plus interest, over a given period.

Key parts of mortgage consist of the primary amount, rate of interest price, funding term, and regular monthly payments. The principal is the original finance amount, while the rate of interest identifies the expense of loaning. Finance terms commonly range from 15 to thirty years, influencing both monthly repayments and general interest paid.

Types of Flexible Funding

Adaptable funding options play a crucial role in fitting the varied demands of buyers, enabling them to customize their home loan solutions to fit their financial situations. One of the most prevalent kinds of flexible funding is the variable-rate mortgage (ARM), which provides a first fixed-rate duration followed by variable rates that rise and fall based upon market conditions. This can offer reduced preliminary repayments, interesting those who expect revenue growth or plan to relocate prior to prices readjust.

Another option is the interest-only home loan, enabling consumers to pay only the passion for a given period. This can cause lower month-to-month settlements originally, making homeownership a lot more available, although it might lead to larger repayments later.

In addition, there are likewise hybrid loans, which combine functions of fixed and adjustable-rate home loans, giving stability for an established term complied with by adjustments.

Finally, government-backed loans, such as FHA and VA fundings, offer versatile terms and reduced deposit needs, providing to first-time buyers and professionals. Each of these choices presents unique advantages, allowing property buyers to pick a funding remedy that aligns with their long-term personal conditions and monetary goals.

Advantages of Adjustable-Rate Mortgages

Just how can adjustable-rate home mortgages (ARMs) profit homebuyers looking for affordable funding choices? ARMs supply the capacity for reduced first rate of interest contrasted to fixed-rate mortgages, making them an eye-catching choice for purchasers seeking to reduce their regular monthly settlements in the early years of homeownership. This preliminary duration of reduced rates can considerably enhance affordability, permitting property buyers to spend the cost savings in various other priorities, such as home improvements or savings.

Additionally, ARMs commonly feature a cap framework that restricts just how much the rate of interest can raise throughout modification periods, offering a level of predictability and protection versus severe variations in the market. This feature can be particularly advantageous in a rising rates of interest setting.

Furthermore, ARMs are ideal for customers that prepare to sell or re-finance prior to the car loan readjusts, enabling them to take advantage of the lower rates without direct exposure to potential rate rises. Because of this, ARMs can act as a strategic economic device for those who are comfortable with a degree of threat and are seeking to maximize their acquiring power in the present housing market. On the whole, ARMs can be a compelling option for wise property buyers seeking adaptable financing remedies.

Government-Backed Financing Choices

FHA financings, insured by the Federal Real Estate Management, are excellent for newbie homebuyers and those with lower credit history. continue reading this They generally require a lower deposit, making them a preferred selection for those that might battle to conserve a substantial quantity for a traditional financing.

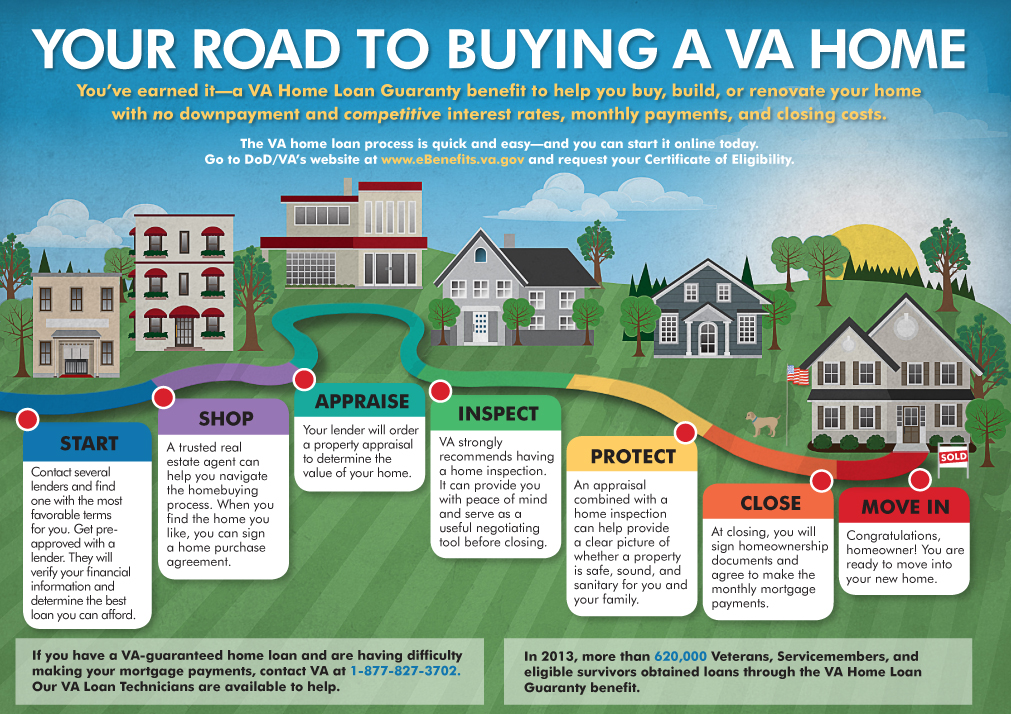

VA lendings, available to veterans and active-duty army employees, use positive terms, including no private home mortgage and no down repayment insurance policy (PMI) This makes them an appealing choice for eligible borrowers aiming to buy a home click here for more without the concern of additional prices.

Tips for Picking the Right Finance

When assessing finance options, customers frequently profit from extensively examining their economic situation and long-term goals. Begin by establishing your budget plan, which consists of not just the home purchase price however likewise added prices such as real estate tax, insurance policy, and maintenance (VA Home Loans). This extensive understanding will assist you in picking a car loan that fits your monetary landscape

Following, think about the sorts of finances readily available. Fixed-rate mortgages offer stability in monthly repayments, while adjustable-rate home loans might supply reduced first rates yet can rise and fall over time. Examine your threat tolerance and for how long you plan to stay in the home, as these factors will affect your financing option.

Furthermore, inspect rates of interest and charges connected with each car loan. A reduced rate of interest can dramatically decrease the complete price over time, however be conscious of closing costs and various other fees that could offset these savings.

Conclusion

In conclusion, browsing the landscape of home mortgage exposes numerous versatile financing options that accommodate varied customer demands. Recognizing the complexities of various lending kinds, consisting of government-backed lendings and adjustable-rate home mortgages, allows informed decision-making. The benefits offered by these funding methods, such as lower first repayments and tailored benefits, inevitably improve homeownership accessibility. A thorough examination of available options Click This Link makes certain that prospective home owners can secure one of the most suitable funding solution for their special economic situations.

Browsing the intricacies of home lendings can commonly really feel difficult, yet recognizing adaptable financing choices is crucial for potential property owners. A home finance, or home mortgage, is a kind of debt that allows individuals to borrow money to purchase a residential or commercial property, with the property itself serving as collateral.Key components of home car loans include the primary quantity, interest rate, car loan term, and regular monthly repayments.In conclusion, navigating the landscape of home lendings reveals numerous adaptable funding choices that provide to diverse customer needs. Understanding the details of numerous financing kinds, including government-backed financings and adjustable-rate home loans, allows informed decision-making.